Singapore's benchmark index was range bound in this week and trading in a very narrow range and struggling around its 50 day MA level of 3049.08.

STI opens with deep gap and made a low for week @ 3027.85 and then it took support @ that level and recovers and crossed its 50 day MA level of 3049.08 and made week high of 3063.Finally closed @ 3057.51 with gain of 8.59 points up by 0.28% wow basis.

MACRO ECONOMIC FACTORS

Inflation in Singapore accelerated in September, driven by higher transport and housing costs. Data from the Department of Statistics showed that the consumer price index (CPI) for all items rose to 4.7 % in September; from 3.9 % in August.August's CPI of 3.9 % was the lowest in almost two years.

MARKET FORECAST FOR WEEK AHEAD

STI facing resistance @ its 3063-65 levels from last 2 weeks and took support near to 3025 levels. On the weekly graph STI formed two candles also @ same levels.

STI breached its support level of 3040 mark below its 50 day MA level but manage it to close well above the support zone.

For the coming week STI look volatile to southern biased as it breached lower levels and closed below the Resistance zone, so if it will sustain below 3040 mark than it will be more bearish.

STI SUPPORT

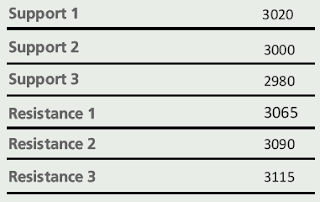

STI having nearest support @ 3020 below this 3000-2980 will be the support area for market.

STI RESISTANCE

STI having Resistance @ 3065 and above this level it may take resistance from 3090-3115 levels.

TECHNICAL INDICATORS

Technical indicators are looking bearish

8:21 PM

8:21 PM

Admin

Admin