Market Review:

STI tumble today as it opens gap down and made its 1 month

low. Amid concerns over the political

uncertainty in Italy, and the lack of progress in Washington to avoid spending

cuts due to take effect on Friday.

Singapore share prices opened gap down @

3269.31 and then it made a high of 3277.12 after that STI fell down and made is

1 moth low @ 3250.87 and finally closed with loss of 34.50 points down by 1.05%

@ 3254.26.

Volume was 6.9 billion shares. Losers led gainers 373 to 127.

Singapore's Industrial Production numbers came in below

expectations for January mostly dragged down by a sharp contraction in the

biomedical sector. Forecast 4 % expansion from a year ago, but manufacturing

output instead contracted 0.4 % on-year.

For the STI, as we mentioned two weeks ago that it has

broken the uptrend line formed since November 2012.Although it tried to climb above

rising trend line on in mid February after Chinese new year. It promptly moved below

the rising trend line. It seems to be consolidating around 3,250-3,320.

Now for coming days 3250 will act as a major support

zone because if STI break this level then it will be more bearish and can touch

3220-3190 levels soon.

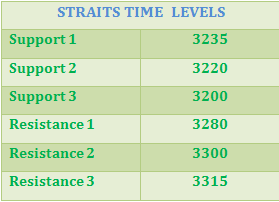

Support:

STI

having immediate support @ 3235 level and below this level it can take support

@3220-3190 will be the support zone for STI.

STI

having immediate Resistance @3280 and above this level it may take resistance @

3300-3315 levels.

Technical indicators:

Technical

indicators MACD, RSI and CCI all are in bearish mode. as we can see in the

chart, RSI trading below its centreline @ 47.060 and CCI also break its -100

level and trading below this @ -143.30 which is bearish indication for market.+

8:29 PM

8:29 PM

Admin

Admin