Market forecast:

Market turns from its recent low of 3250.87, and closed

with gain on 2nd consecutive day but not able to sustain the higher

levels.

Today STI formed a candlestick pattern called “Three inside Up”, another name for the Confirmed Bullish Harami Pattern. The

third day is confirmation of the bullish trend reversal.

The first 2

days of this pattern is simply the Bullish Harami Pattern, and the third day

confirms the reversal suggested by the Bullish Harami Pattern, since it is a

white candlestick closing with a new high for the last three days. The

reliability of this pattern is very high.

Now for coming days 3250 will act as a major support

zone because if STI break this level then it will be more bearish and can touch

3220-3190 levels soon.

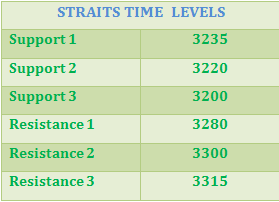

Support:

STI

having immediate support @ 3260 level and below this level it can take support

@3240-3220 will be the support zone for STI.

Resistance:

STI

having immediate Resistance @3285 and above this level it may take resistance @

3300-3315 levels.

Technical indicators:

Technical

indicators MACD, RSI and CCI all are in bearish mode. As we can see in the

chart, RSI trading above its centreline @ 51.878 and CCI recovers some points

from -119.93 today closed @ -70.947

9:04 PM

9:04 PM

Admin

Admin