Market

Forecast for week ahead:

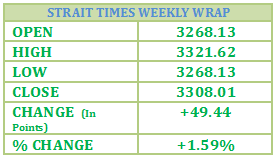

- STI closed its 7 week high level above 3300 mark @ 3308.1 levels. Took support near to 3365 levels and recovers very well.

- STI formed a candlestick pattern called “opening marubozu” is a type of candlestick characterized with a very long body and no lower shadow. It has only a short upper shadow. This is a strong bullish candlestick pattern.

- This shows that the day opened and then the prices continued to go up all day long without coming below the opening level thus forming a long white body, however prices did not close at the high of the day and thus they created an upper shadow. It is a typical bull day and strength of the bulls is enough to cause some concern among the bears. A White Opening Marubozu, on the other end, does not show as much bullish strength as in the case of White Marubozu.

- STI trading in a consolidation phrase between the ranges of 3220-3320 levels, either side breakout will give the clear move for coming days.

STI

Resistance:

- STI having Resistance @ 3320 and above this level it may take resistance from 3335-3350 levels.

STI

Support:

- STI having nearest support @ 3260 below this 3240-3220 will be the support area for market.

Technical

Indicators:

Technical

indicators are giving bullish impression.MACD looking good.RSI

trading above its centreline @ 67.336 and CCI also turning upwards

and trading at 79.92.

| Support 1 | Support 2 | Support 3 | Resistance 1 | Resistance 2 | Resistance 3 |

| 3260 | 3240 | 3220 | 3320 | 3335 | 3350 |

8:52 PM

8:52 PM

Admin

Admin